Virginia's economy has created "data center alley," the largest concentration of data centers in the world. The whole world! And Virginia has been powering them with our dirty coal-fired power from West Virginia. This is what has made Loudoun County, Virginia, the wealthiest county in the nation. The whole nation!

And there Virginia sits, sneering at West Virginia and making jokes about how we're at the bottom of many state achievement lists and maligning us as a bunch of hillbillies who actually LIKE being trodden by Virginia's polished boots on our neck. If there's something the "civilized" in Northern Virginia want that comes with impacts, they look right away to West Virginia as their sacrifice zone.

Today's West Virginia is DONE with that!

Now Virginia wants to build out a network of AI data centers, the largest in the world. But Virginia also doesn't want to have the infrastructure necessary to power those data centers in their own back yard. Virginians would yell and scream about the protection of their environment, while demanding that the infrastructure they don't want be moved to West Virginia.

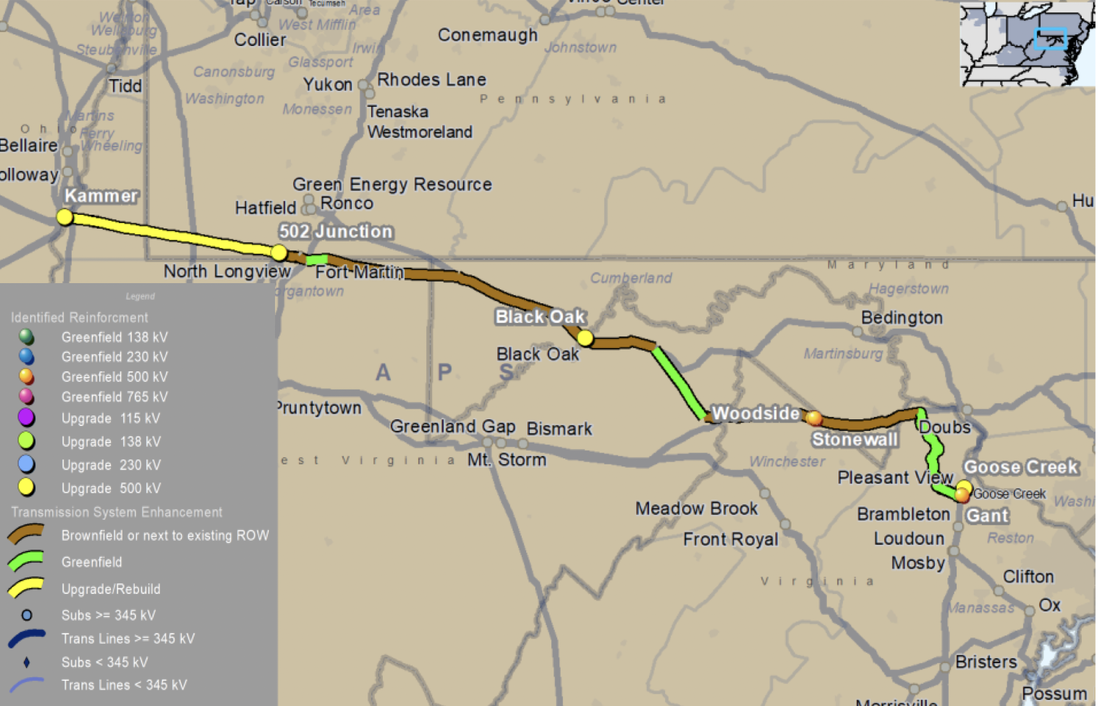

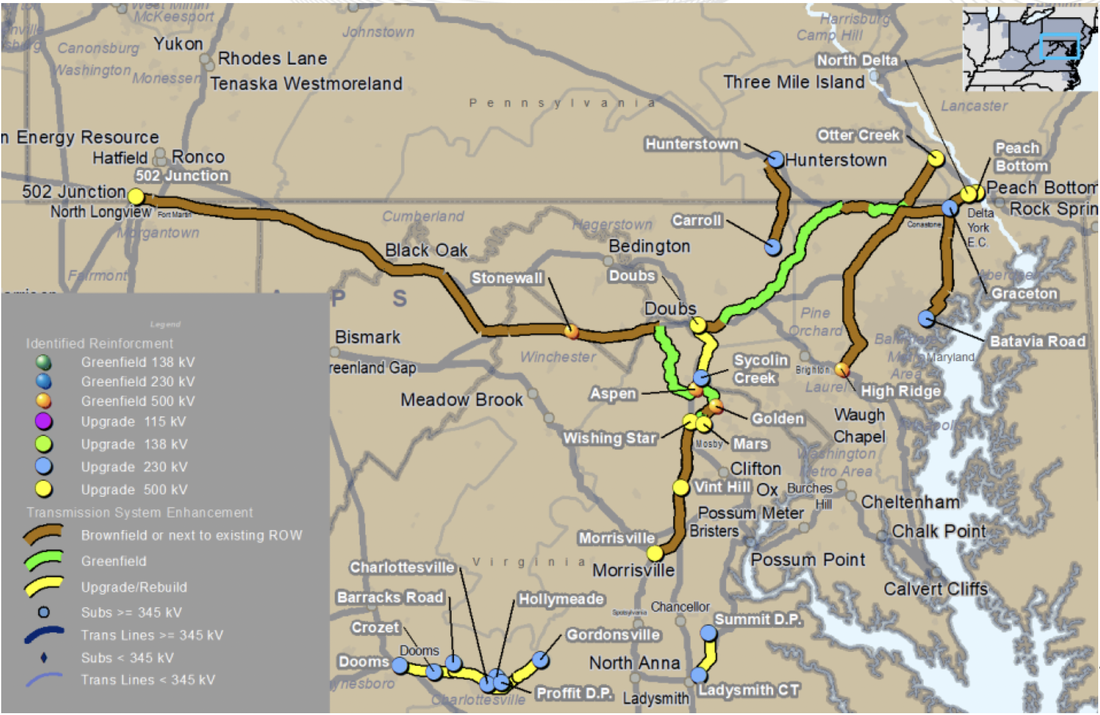

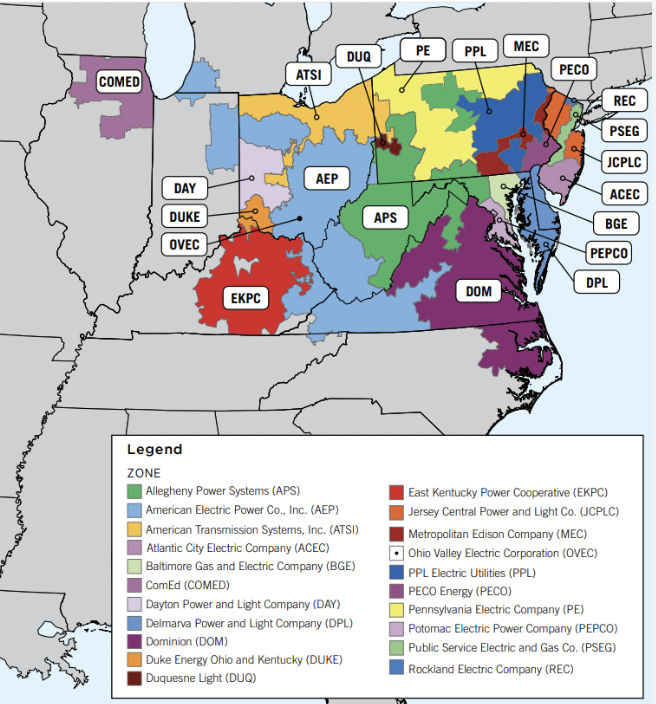

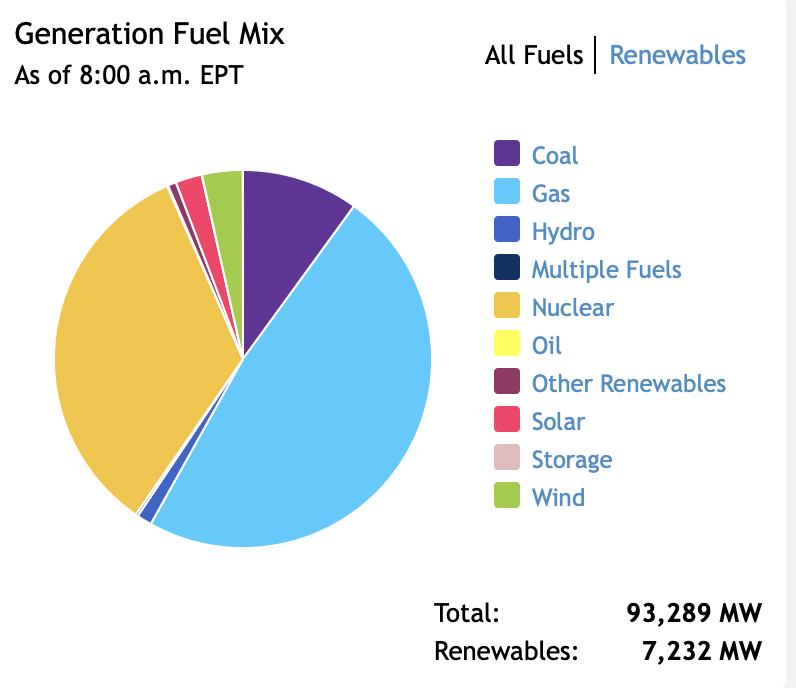

Instead of building the infrastructure to power the data centers Virginia wants near the load they are creating, Virginia is playing a coy game with regional grid operator PJM Interconnection. They simply encourage new AI data centers to make load requests to Virginia public utility Dominion Energy. Dominion sends these impossible load forecasts up to PJM Interconnection, and PJM uses the only tool at its disposal to meet the load request of a public utility... transmission! PJM does not and cannot order the construction of new generation. It can only plan and order transmission, and that's exactly what it's done... planned and ordered new transmission extension cords from West Virginia's coal-fired power plants to serve the new AI data centers in Virginia. West Virginia's public utilities, owned by corporations based in Ohio, are thrilled with this arrangement because they not only make money selling more electricity produced in West Virginia, they also rake in billions of dollars building new transmission extension cords.

This has to STOP!

AI data centers can be built practically anywhere that there is power and water available. They don't need to be located within Northern Virginia's data center alley. AI data centers could actually be built in West Virginia, in communities that want them and their tax revenue. That's exactly what West Virginia's elected officials were thinking this year when they passed The Power Generation and Consumption Act (aka HB 2014). However, it seems that data companies are hardly beating a path to our door. Instead, there was a big announcement recently where Pennsylvania became the home to many new data centers in the planning stage.

Apparently it takes *more* than just allowing data centers to build their own generation. And it's all about who pays! West Virginia's Power Generation and Consumption Act makes the data center pay to build its own power. Other states simply push the service requests up to PJM interconnection, who orders new transmission that electric consumers pay for. West Virginia is also a vertically integrated state where utilities own generation, transmission and distribution. Generation built by our utilities is paid for by West Virginians. When data centers get built in other states, West Virginians end up footing the bill to power them! Frankly, that is OUTRAGEOUS!

After all these years, West Virginia finally has something other states want. West Virginia needs to quit giving it away and being satisfied with the crumbs left from the other state feasts.

Take back your power, West Virginia! Don't allow new transmission extension cords that drain our power to be built in West Virginia! West Virginia has the final say whether new transmission extension cords are built in West Virginia. If West Virginia keeps allowing other states to siphon off our power, there's nothing here to attract data centers. They'll locate in surrounding states and suck all our power out of West Virginia.

Say NO to new transmission extension cords providing OUR power to surrounding parasitic states! If we keep feeding new data centers in Virginia, they never have any reason to build here instead. Keep our power here, providing economic development to our own state.

Take back your power, West Virginia! Say NO to new transmission extension cords across our beautiful state!

RSS Feed

RSS Feed