I sat through the entire first day of the conference, where PJM's resource adequacy was discussed, and took copious notes... so you didn't have to.

Now it's time to act!

Tell FERC that transmission extension cords across West Virginia are NOT the answer! It’s quick and easy to do with FERC’s online comment form!

Don’t know what to say? Here’s a little help.

Commenting on FERC Docket AD25-7

- Existing generation is retiring and not enough new generation is being built.

- Data centers, especially Artificial Intelligence, are creating skyrocketing load.

- Transmission extension cords to import existing generation hundreds of miles to serve new data center load is inefficient, has devastating impacts, takes too long, and is the most expensive solution.

- Transmission extension cords will take private property in West Virginia.

- Transmission extension cords will cost West Virginians more than $440M and provide no benefit to West Virginia. Reference IEEFA study.

- West Virginia is an electricity exporter.

- Virginia is an electricity importer and wants transmission from West Virginia to increase imports to serve their data centers.

- West Virginia’s Power Generation and Consumption Act allows companies seeking to build data centers in the state to create their own, independent energy grids to power them.

- West Virginia’s Power Generation and Consumption Act requires data centers to pay for and build their own power on site. Does not require new transmission and does not shift costs of providing power to ratepayers.

- Data centers are not just another electricity customer who must be served using existing rules that share burden among all consumers.

- Data centers must be responsible for bringing and paying for their own power.

- Resource adequacy cannot be solved by building more transmission.

- Resource adequacy can be solved by building new generation at data centers.

- Resource adequacy will be solved if data centers become the solution, and not the problem.

Comments of Keryn Newman

Docket No. AD25-7

“Breaking the internet” is a figurative phrase coined to describe an overwhelming surge in web traffic that impedes the operation of the World Wide Web. In an ironic twist, the internet is now breaking us, or more precisely our grid. The generators, transmission lines and distribution systems that make electricity available to everyone can no longer function in the same way they have for decades because they have been overwhelmed by new service requests from artificial intelligence data centers.

This enormous surge in electricity demand is breaking energy transition goals, bedrock regulatory principles, how we plan the energy system, and PJM’s capacity market, just to name a few. It is also breaking consumers ability to pay for the electricity they need. Soon it could even impede their ability to receive service at all as the amount of electric generation continues to shrink and the amount of electricity required by artificial intelligence skyrockets. We are sacrificing our real, human world for an artificial one that exists inside machines.

Our entire energy system and the way we regulate it needs to be torn down and rebuilt to efficiently and cost effectively serve today’s reality. Of course, that cannot happen. We no longer have the luxury of time. Elected officials and regulators have ignored the clear warning signs that were present for a number of years in favor of indulging in politicized industry fantasy. The fantasy is over. It’s now reality.

At FERC’s Resource Adequacy Technical Conference, Commissioner Christie asked whether states should require load-serving entities to acquire enough generation to cover their load forecasts in advance, requiring that they build or buy sufficient generation to meet load. That ought to be the first condition to be a member of a resource sharing organization such as PJM Interconnection, but it is not. PJM states such as Virginia are raking in the cash and benefits created by new data centers and leaning on other states to supply the power they need to enable those new data centers. As Commissioner Christie pointed out during the technical conference, when everybody leans on everybody else, everybody eventually falls down.

Importing more electricity from a neighboring state to serve increased demand is not smart energy policy. It’s a house of cards that cannot stand. PJM has become a group of “haves” and “have nots.” PJM’s State Import-Export Map shows a real time picture of which states are importing electricity, and which states are exporting it. West Virginia and Pennsylvania are consistent electricity exporters. Virginia, Maryland, Washington DC, Delaware and New Jersey are consistent energy importers. It is no longer an equitable sharing of resources among states. There are states that have energy, and states that have not. There are states that are givers, and states that are takers. Where’s the value of PJM membership for the states that are consistent exporters and perpetual givers? There is no value when one state is consistently taken advantage of over and over again. West Virginia has been treated as the east coast’s sacrifice zone, exploited by corporations to benefit wealthier states and treated like a dump that becomes the butt of rude jokes. But, perhaps artificial intelligence is also breaking West Virginia’s victimhood. This year West Virginia approved a new law called the Power Generation and Consumption Act, which allows companies seeking to build data centers in the state to create their own, independent energy grids to power them. West Virginia is getting into the data center game, trying to lure the industry here where energy is plentiful and data centers can bring their own generation and be part of the solution, not just the problem. It makes so much more economic and engineering sense to bring the load to the power than to try to bring the power to the load. West Virginia has found a way to accommodate data centers that does not create financial burden on other ratepayers, or land use burdens on private property.

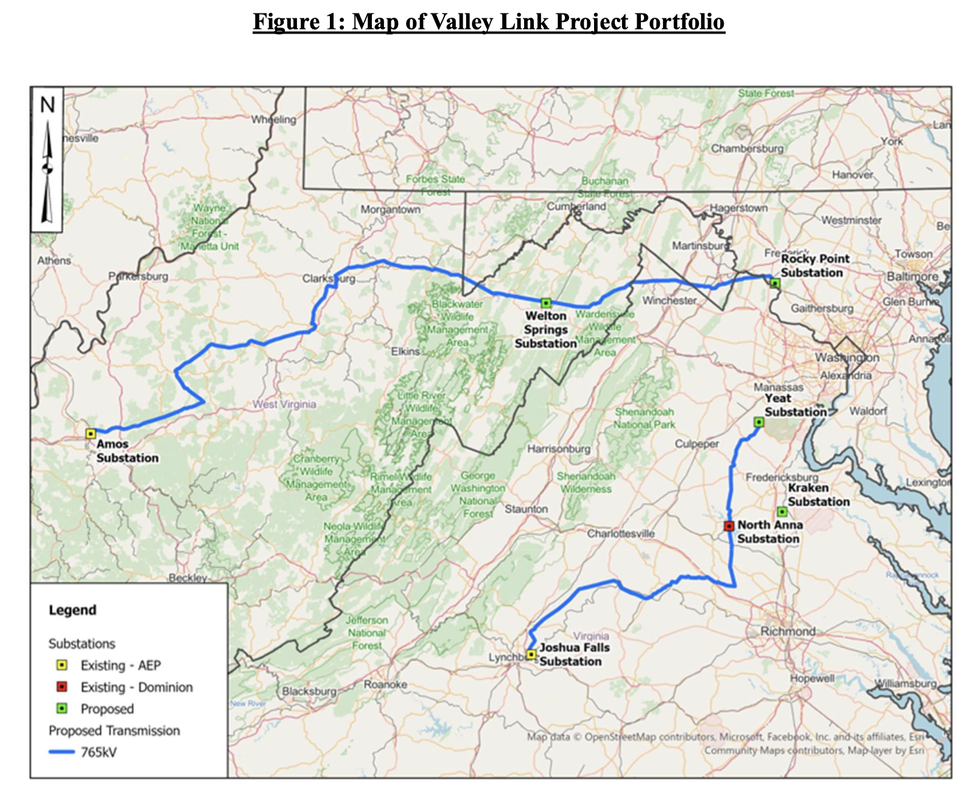

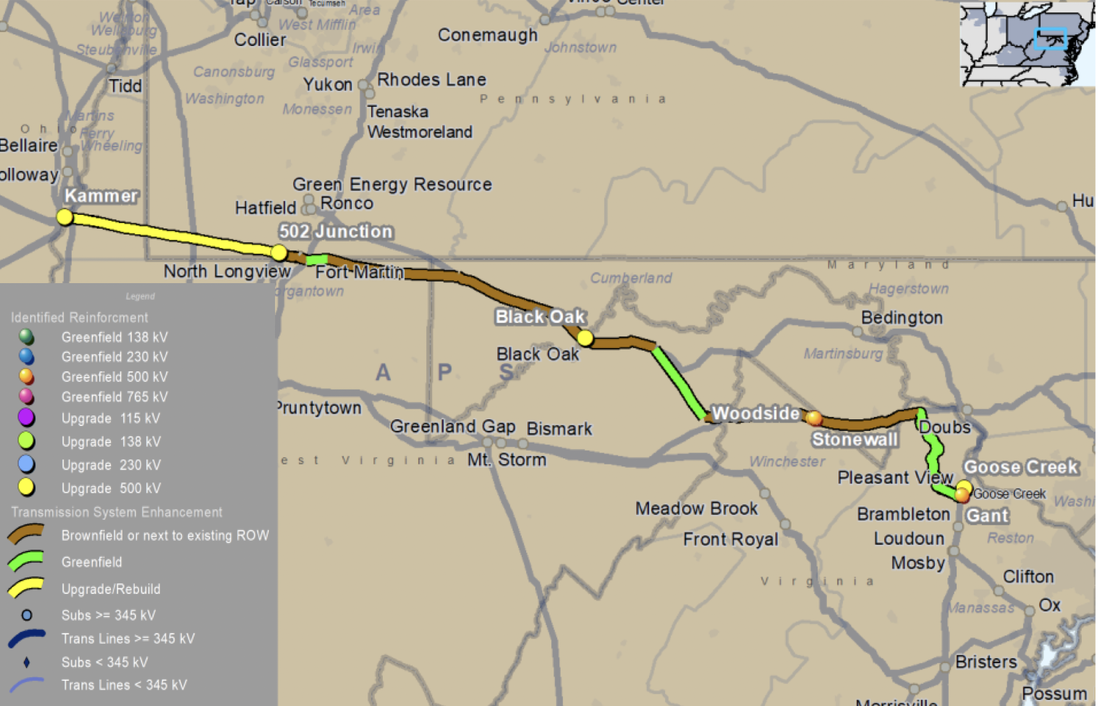

Over the past several years, PJM Interconnection has planned and ordered more than $11B worth of new baseload transmission to import more and more electricity to Northern Virginia’s “data center alley” from West Virginia and Pennsylvania. These new transmission lines do not provide benefit to West Virginia and Pennsylvania. They are nothing more than gigantic extension cords for the purpose of exporting resources to “have not” taker states, mainly Virginia.

The resource adequacy crisis needs an immediate solution. Satisfying new data center demand can be done three different ways. The fastest and cheapest way is to restrict new data centers to locations with onsite or nearby available power. The second would be to build new generation near data center load, but that takes more time to permit and build and the price is steep. The last, most time consuming and expensive option would be to build transmission extension cords from existing generation to new data centers in other localities. Instead of selecting the fastest and cheapest option for the grid, PJM and the Commission have opted to rely on the slowest and most expensive way to power new data centers, building new transmission. This is not a viable solution and will take much too long to implement because new transmission is never a sure thing.

The impacts of Virginia’s skyrocketing data center load will be devastating to West Virginia, which is primarily bearing the brunt of the Commission’s broken regulatory system that no longer assists consumers in obtaining reliable, safe, secure, and economically efficient energy services at a reasonable cost through appropriate regulatory and market means, and collaborative efforts. West Virginians will pay more than $440M to construct and operate two new transmission extension cords for Virginia's data centers. The MidAtlantic Resiliency Link is a new 160-mile 500kV line that will take a new 200-foot wide right-of-way through private property. Valley Link is a new 261-mile 765kV transmission line that will take an additional 200 ft. wide right-of-way through private property. In Hampshire and Jefferson Counties, West Virginia, these two separate transmission lines will converge to create a transmission superhighway as wide as two football fields laid end to end. Hundreds of homes may be taken and demolished to make way for Virginia’s insatiable appetite for new data centers. There are no benefits for West Virginia, just impacts. Membership in PJM and the Commission’s transmission planning and cost allocation procedures no longer work to provide benefit to West Virginians. We’re being used to benefit other states.

The Commission has been constantly tinkering with interconnection queues, markets and other forms of regulation but has yet to find a solution to the growing problem of resource adequacy. There seems to be little the Commission can do in the face of rapidly increasing load from data centers. All its tools no longer work. What the system needs is more generation near data center load. Because Virginia refuses to build it, other states are being torn apart for new extension cords and consumers are quickly being priced out of being able to afford basic electric service. The system is broken.

Data centers are not just another electricity customer who must be accommodated using existing rules that share burden among all customers. The Commission should take a page from West Virginia’s book and require data centers to bring their own power to wherever they choose to locate, or locate where they may directly connect with generators with excess capacity. Those localities that will not allow data centers to build their own generation cannot continue to lean on the system to support their own economic development. It’s parasitic. Once data centers are separated from the host they have been feeding on and become self-reliant, the resiliency problem solves itself. We simply don’t have any more time to wait while the Commission slow rolls minor fixes here and there and hopes for results.

RSS Feed

RSS Feed