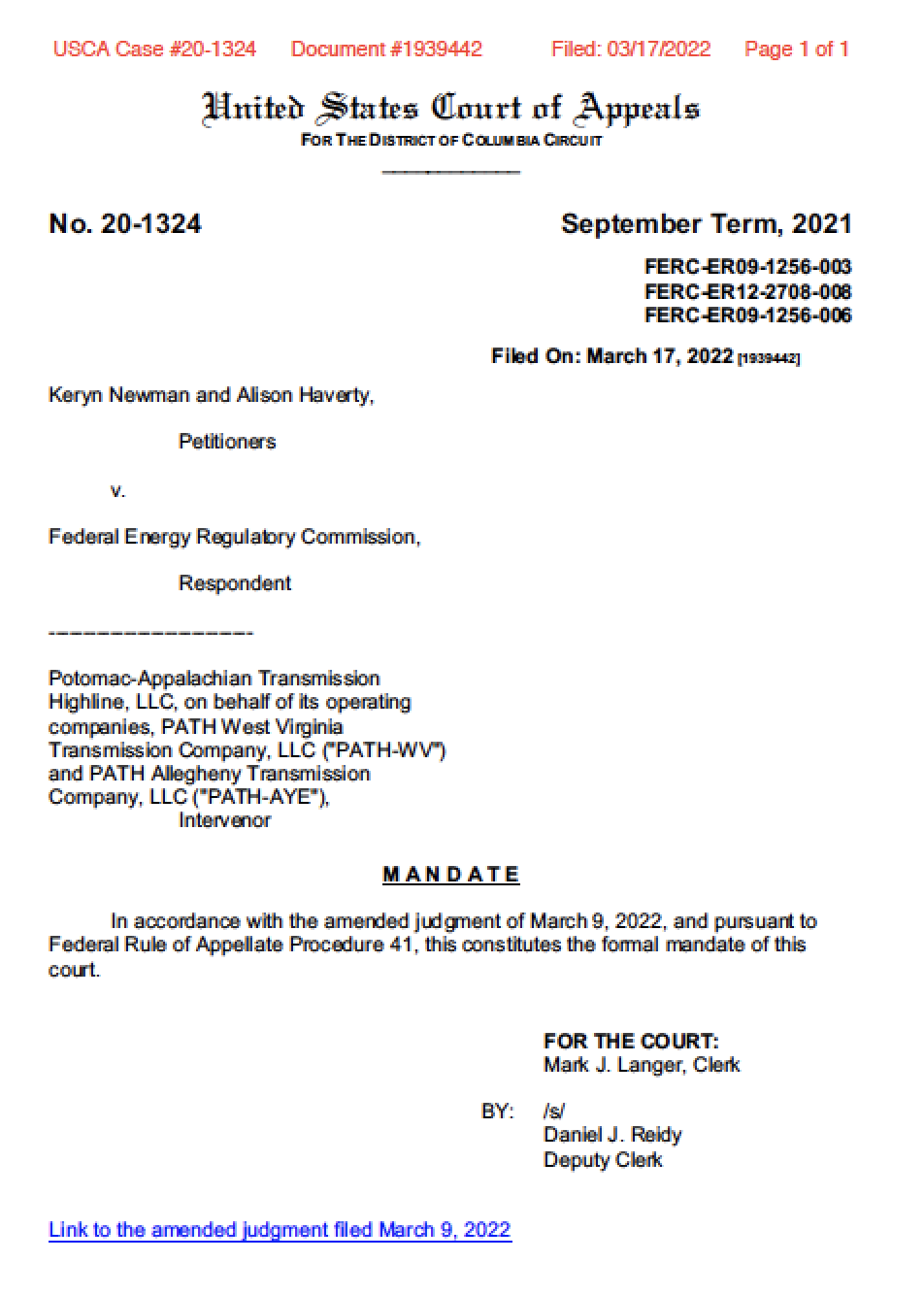

An uncontested settlement was filed at FERC on November 17 that created a lump sum refund for PJM ratepayers of $9.5M. The refund came as a result of the DC Circuit Opinion back in 2021 that determined PATH's advocacy and advertising costs should not have been collected from ratepayers. Also included in the lump sum was a final accounting for money due under PATH's formula rate. The settlement also provides for the cancellation of PATH's formula rate and cancellation of the companies themselves. In several months, PATH will be nothing but a bad dream and a lightness in your wallet.

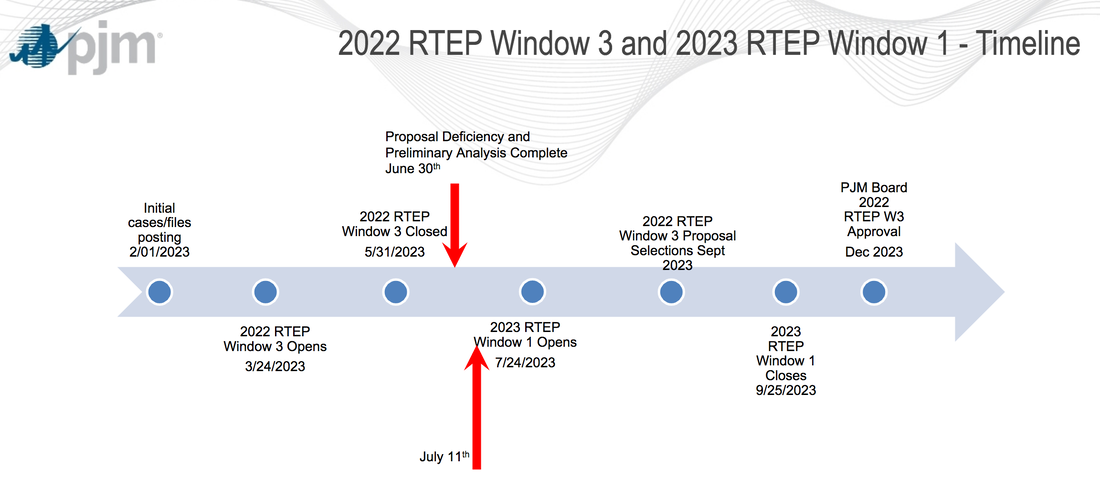

Because FERC had failed to act (again) on the DC Circuit remand and a paper hearing FERC opened on PATH's return on equity in 2020, the parties to the long-running formula rate and abandonment cases took it upon themselves to ink out a deal and present it to FERC for approval. FERC allowed PATH to begin collecting money for its project beginning in 2008, and it won't stop collecting until 2024. That's 16 years. Much of that time came courtesy of an overworked and tone-deaf FERC simply ignoring the issues PATH created for years on end. Two years to grant our formal challenges, 3 more years to get them to hearing, 2 more years to issue an order, 3 more years to grant rehearing and do a 180 on FERC's first decision, only a year at the D.C. Circuit Court of Appeals straightening that out, and then 2 more years before the settling parties, including yours truly, finally pulled the plug to short circuit another long period of waiting for FERC to act. To its credit, FERC jumped right on the settlement when it was presented and approved it yesterday, just a mere month after it was filed. But why did it take us doing FERC's job for them to get this resolved?

Yesterday, a public shaming of PATH, utilities, PJM, and FERC itself came courtesy of FERC Commissioner Mark Christie during the monthly Commission meeting. You can watch it here beginning at minute 13:48 and ending at 18:24. Just five minutes of your time to get the satisfaction you've been seeking for 16 years. I love a happy ending like this! PATH was a terrible idea that has caused harm to consumers.

Commissioner Christie has been on the warpath against certain overly-generous FERC incentives, issuing strongly worded statements in 13 cases over the past 2 years (all footnoted in yesterday's statement). He pointed out that FERC has opened several proceedings to investigate and change the Commission's incentive rules since 2019, but still has not managed to conclude those proceedings (PL19-3, RM20-10). Christie also noted that the Commission proposed discontinuing the CWIP incentive in its also pending Rulemaking on Transmission Planning (Docket RM21-17).

A highly politicized FERC means the agency can't get anything done and has found itself at a standoff over many issues over the past 8 years. Commissioner Christie stands alone as the most consumer-focused Commissioner FERC has ever had. He has tirelessly fought for consumers and will continue to do so. Commissioner Christie came to FERC from the Virginia State Corporation Commission in 2021, and will serve until 2025. We need more commissioners like Christie, who have a history of serving at state utility commissions, and less Commissioners from the political and special interest realms that have dominated appointments over the past 8 years. FERC needs to go back to its function as an impartial regulator, not a political vehicle for the policies of the administration in charge. Sadly, I don't see things changing much in 2024.

Commissioner Christie used yesterday's PATH settlement as a lesson and a warning, referring to it as an "omen" of more bad things to come if FERC's policies are not reformed. He used PATH as an example of how these different policies come together to create zombie projects that can pick ratepayer pockets for decades. According to Christie, PATH was originally part of Project Mountaineer, a PJM scheme to import electricity to eastern load centers from the Ohio River Valley's massive fleet of coal-fired generators. Once PJM approved PATH and added the project to its regional plan, that turned on the money spigots. Thanks to FERC's overly-generous award of every incentive possible and its use of formula rates, PATH began collecting its costs from ratepayers in 2008, during its development and permitting stage. The Commission's policies allowed PATH to continue to collect its costs during the long period between PJM's approval and state regulatory approval. Although PATH never received any state approval, and nothing was ever built, its formula rate continued to recover costs from consumers, even after PJM abandoned the project in 2012. PATH is still collecting a cool million (or more) from consumers every year to this day. The Commission's approval of the settlement yesterday shuts off the money spigot... finally.

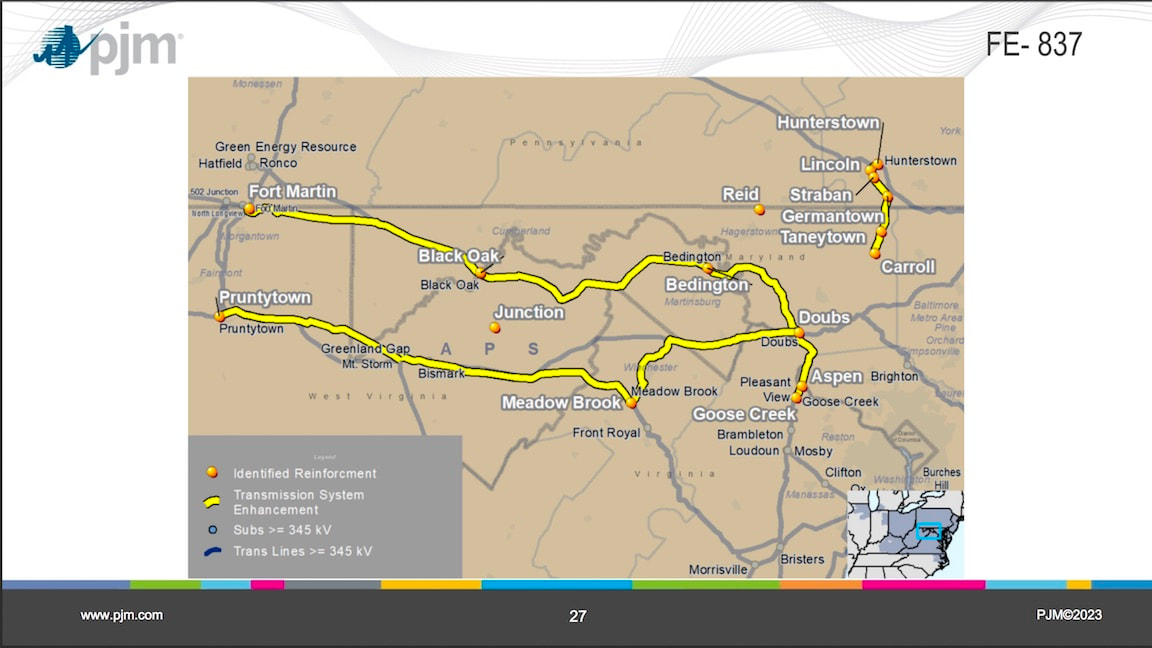

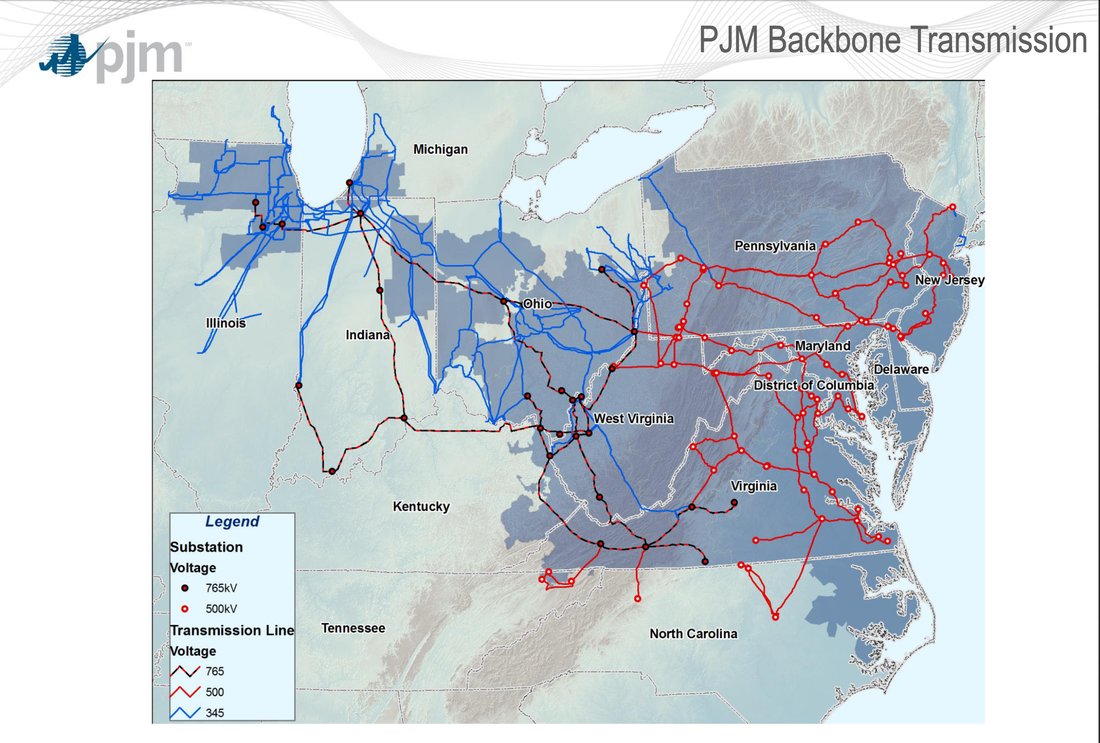

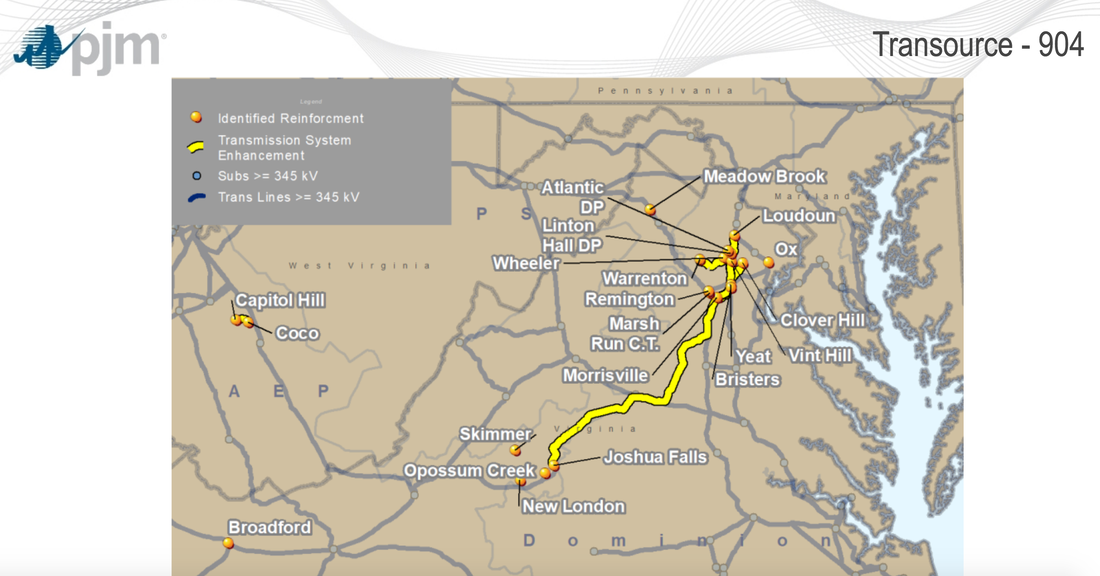

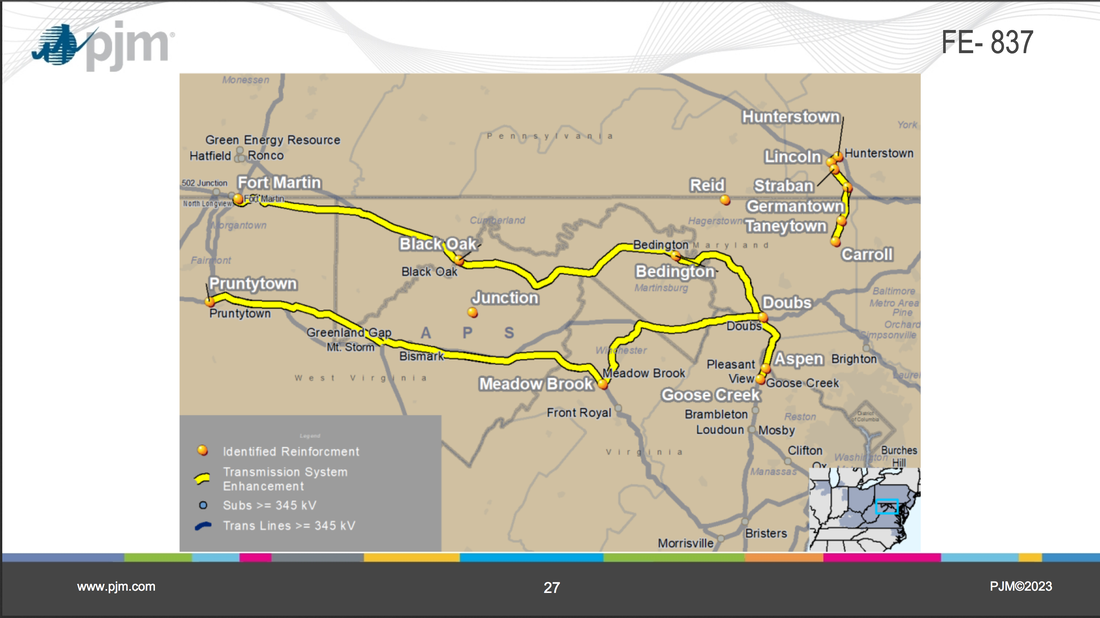

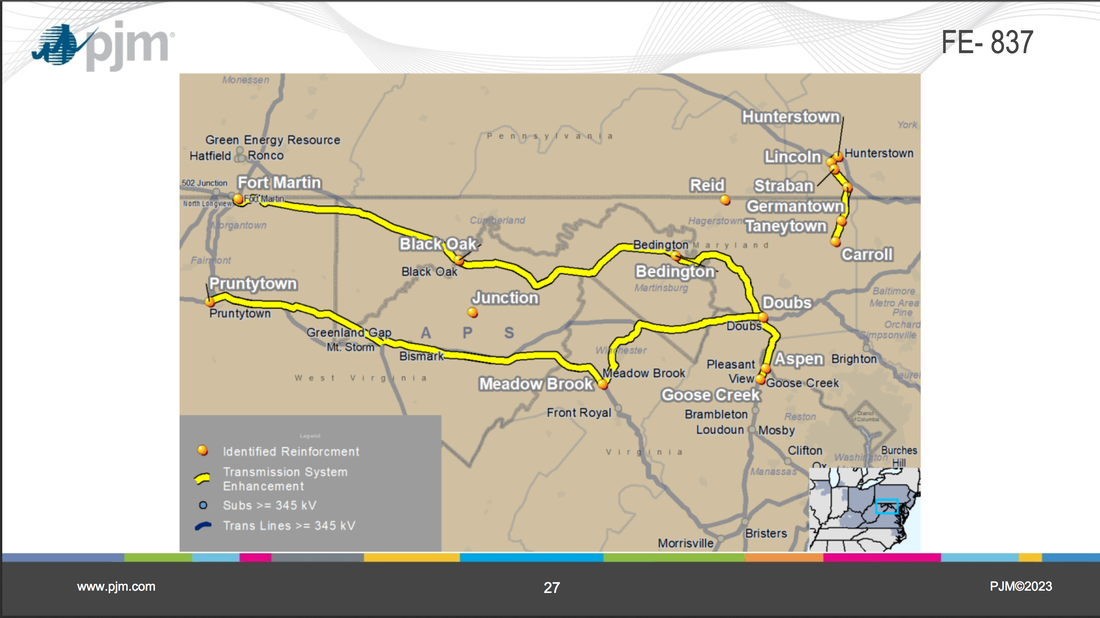

Commissioner Christie cautioned against making long-term transmission plans based on today's generation choices. PATH demonstrates that those choices can change quickly, although the transmission projects set in motion to achieve them cannot. It was wise advice to a Commission that is poised to pass new long-term transmission planning rules in 2024 based on today's generation choices of wind and solar. The Commission needs to think carefully about saddling consumers with the cost of new transmission that could become obsolete before it is even built, such as PJM's recent slate of projects for the purpose of importing fossil fuel electricity to Virginia's data centers from the Ohio Valley. PJM has acknowledged that new wind and solar additions are not keeping up with fossil fuel generator retirements in its eastern regions, but yet the generators keep closing and the data centers keep being built. Something has to change, or the lights are going to go out. PJM chose to approve a bunch of new PATH projects from the west, including the NextEra/FirstEnergy project from southwest Pennsylvania to Loudoun County.

We should all heed Commissioner Christie's warning, and support needed changes to FERC's incentives and transmission policy choices. A group of consumers filed comments on FERC's transmission planning rulemaking back in 2021. Check out the discussion of the PATH project beginning on page 21.

| rm21-17_reply_comments_final.pdf |

Let the funeral dirge play... we beat you, PATH. We beat you BAD.

RSS Feed

RSS Feed