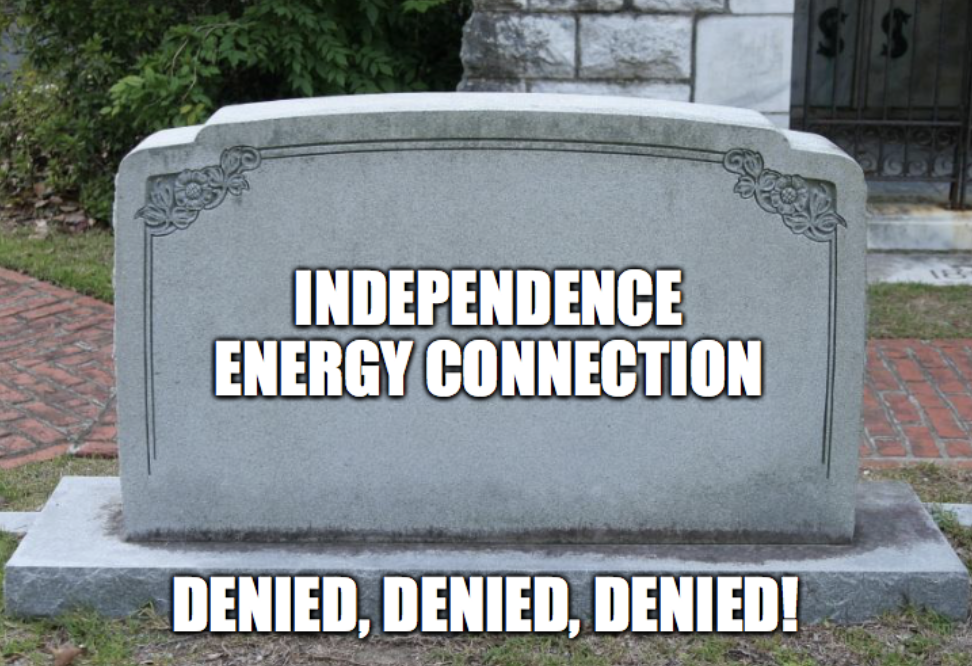

Utility rag T&D World asks, "Are utilities forgetting some key aspect of successful project development, or has the world changed, or both?" in a new piece entitled, "A Teachable Moment Regarding Transmission Development."

The article asks

Are we not doing an adequate job of incorporating the input of all stakeholders or resolving major conflict during the development stage? If parties remain opposed to a project after a final decision is made, have we reached a time in our society that the risk of proceeding with a project may be too great even if an approval has been granted? In the project sited above (NECEC), the primary benefits appear to accrue to one state and most opposition as well as the agency suspending construction are from another. In fact, the issue on the ballot in the opposing state, which could permanently enjoin the project under construction, supports local transmission while increasing the difficulty of gaining approval for EHV and DC transmission that does not directly benefit the local communities it impacts.

The Infrastructure Investment and Jobs Act (the Act) passed in November 2021 grants FERC broader transmission siting authority within national interest transmission corridors and allows the DOE to become an anchor tenant for new transmission projects.

Frankly, we do not know if the Act will help get new transmission built. Unquestionably, it has never been more difficult to obtain consensus regarding major new long distance, interstate, and international transmission projects. Such projects should be designed to deliver demonstrable benefits outweighing the impacts for all affected parties.

These benefits cannot be created as a handful of colorful beads. Fly over folks aren't that stupid. We know we're not getting anything and condescending offers of measly bribes just aren't going to cut it. Take your bribes elsewhere... we know they're nothing but crumbs from your taxpayer-funded feast. We're not so dumb that we're going to pay to bribe ourselves while utilities laugh all the way to the bank.

Transmission developers may need to borrow from other energy business segments to provide compelling economic strategies for landowners, host communities and other stakeholders to support new projects. The outright purchase of the required land for a project as opposed to a one-time purchase of a ROW is one example utilities have employed. Offering a production-based payment to landowners and providing a community stipend or other benefits has proven successful in the gas exploration and wind industries. Applying these methods to transmission projects would ensure those living with the project will receive continuing tangible benefits.

Also, providing impact payments does absolutely NOTHING to remove the impacts. It's a payment in exchange for being impacted. Would the utilities spend more money trying to force participation than they could by creating projects that have no impacts? Certainly. How about not creating those impacts in the first place?

Transmission buried on existing rights of way does not create community or landowner impact. It's more expensive up front, but it produces a wealth of ratepayer savings over time. Such savings include not only the cost of battling opposition and the time saved in being unopposed, but also saves the costs of community bribes and outsized payments for obtaining land voluntarily. It also saves future vegetation maintenance costs (because an existing right of way is already being maintained), costs of land agents, legal costs for obtaining land through eminent domain, as well as the legal costs of contested permit proceedings. It saves costs of frequent repairs because underground lines fail less often since they are not subject to damage from weather, fire, or sabotage. Building underground will likely fully pay for itself if it prevents just one blackout.

Unopposed transmission can be built quickly, and spending more increases utility returns over the long term. A long slog to build opposed "cheap" overhead transmission on new rights of way would not end up being cheaper in the long run. When are these folks going to wake up?

Transmission opposition is not going away until transmission impacts go away. Shouldering the burden of new impacts is particularly maddening for landowners when the transmission project is driven by policy and politics, and not by need for the new transmission. Policy does not create physical need.

The power industry is operating in a new era of public activism complicated by policy driven as opposed to strictly need based infrastructure development goals. Successful future projects will require in depth collaboration to get all stakeholders on board and rowing in the same direction.

RSS Feed

RSS Feed